Proposal “DIF-suplemental-funding-Nov“ (Completed)Back

| Title: | DIF Suplemental Funding (November) |

| Owner: | TheDIF |

| One-time payment: | 400 DASH (15792 USD) |

| Completed payments: | 1 totaling in 400 DASH (0 month remaining) |

| Payment start/end: | 2021-11-12 / 2021-12-11 (added on 2021-11-18) |

| Votes: | 738 Yes / 131 No / 5 Abstain |

Proposal description

Dear Network,

This proposal is part of two proposals submitted for funding this cycle.

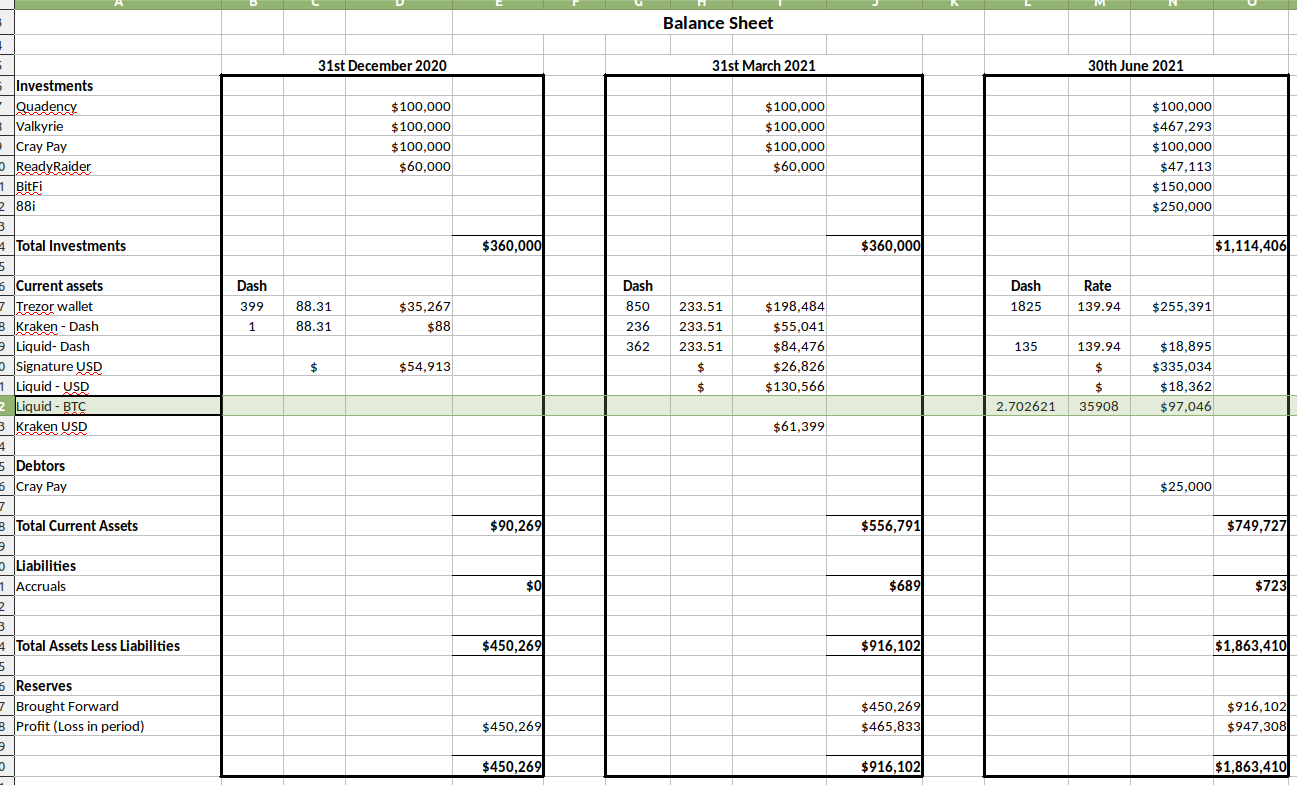

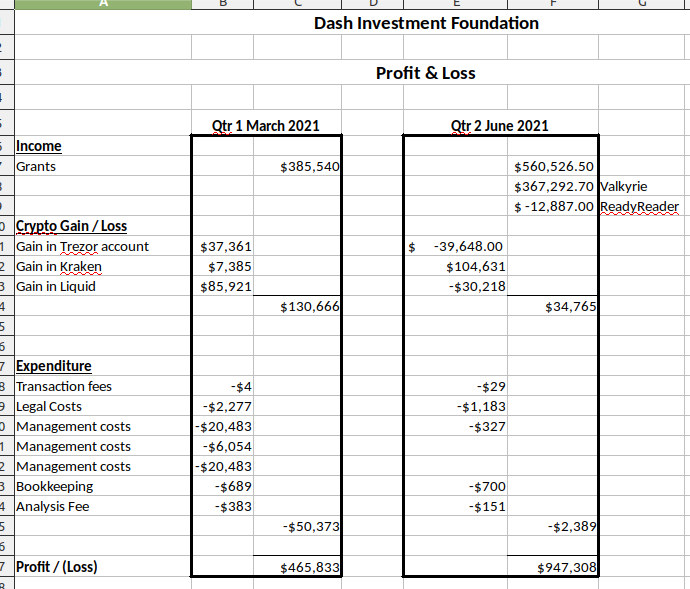

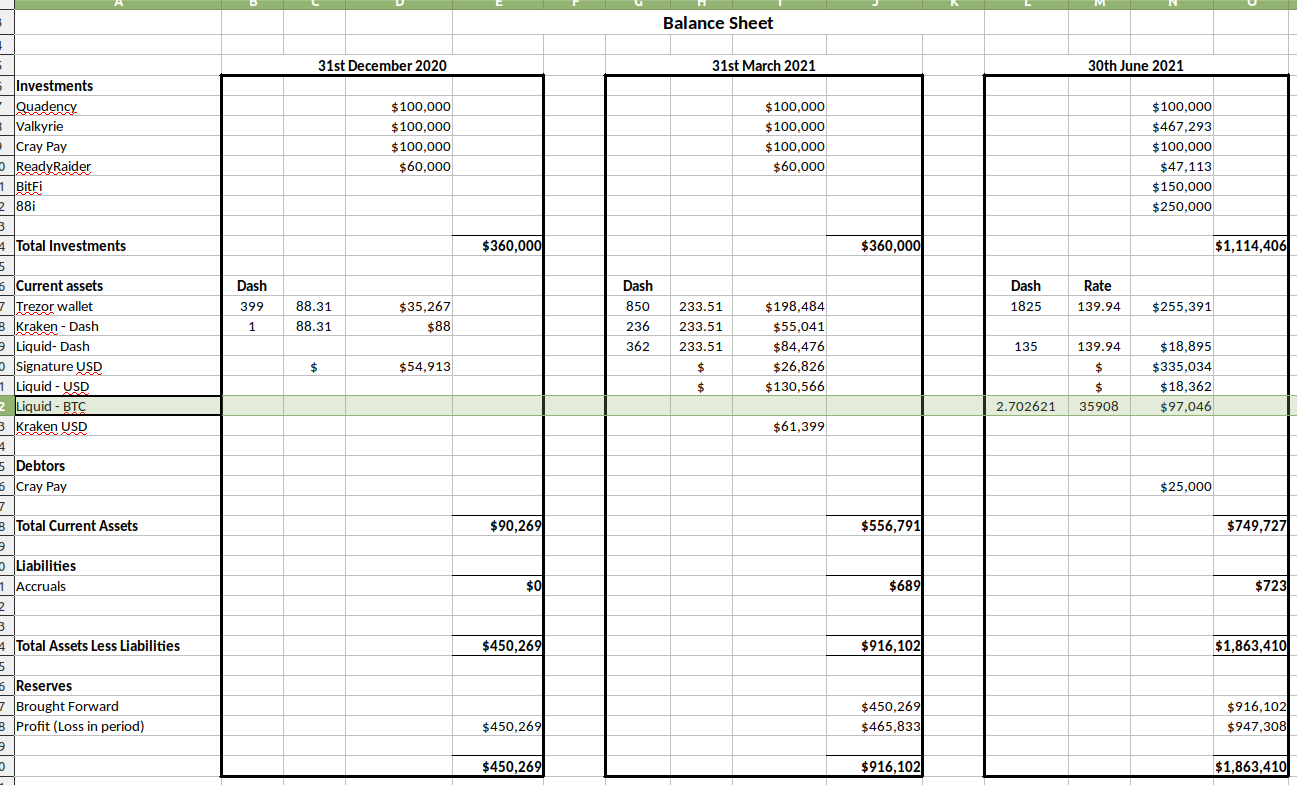

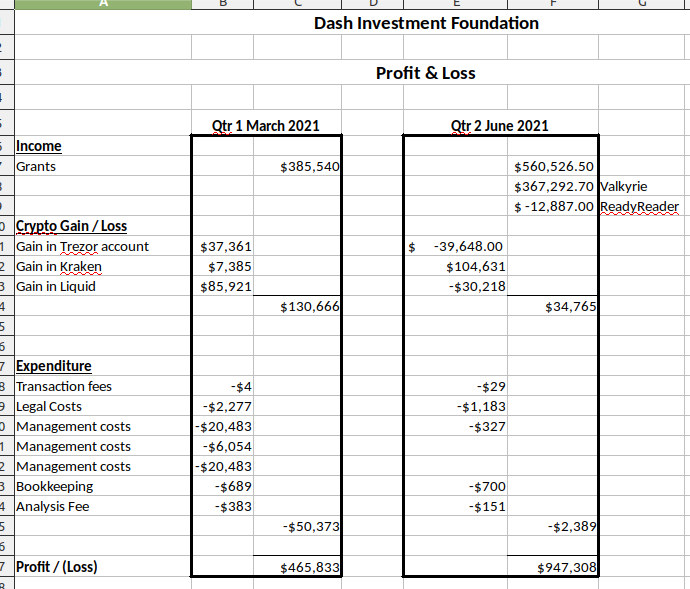

Our book keeper has prepared our Q2 balance sheet and profit and loss statement. Please find these below. After those statements you can find an update about Q3 and Q4 activities.

The sheets above are through Q2. The equity in ReadyRaider was reported at a

different valuation in Q2 because supervisors identified a reporting

error early on. The new valuation was the value of the Dash ash

ReadyRaider received it. This valuation change is only for reporting and

should not reflect on ReadyRaider as a business. The closing of

Valkyrie's Series A valued the DIFs equity at a multiple. You may notice

2.7 BTC on our balance sheet. This was set aside for the purchase of

rune of THORChain. Those purchases began shortly into Q3.

In Q3 the DIF was very active with meetings, however our financial situation

was not that eventful. The DIF offered a $50k line of credit to CrayPay

secured by Dash and giftcards. The DIF felt the banks could not

accurately price the risk of accepting Dash as there is no charge back

risk with Dash. The DIF offered to provide credit at a lower interest

rate compared to the banks. CrayPay also made an interest payment (in

Dash to the DIF) in Q3. In Q3 the DIF also invested an additional $100k

in CrayPay. Two main reasons for this is we learned that CrayPay is even

stronger of a business than it was a year ago. We were also pleased

with the delivery of DashDirect.

In Q4 we have invested $450k in two companies, we are waiting on the green light from our new partners before we disclose them.

Expenses in general

From our profit and loss statement, you can see the management costs in

Q1. Two of these items are for each of our directors. The smaller item

is for the secretary which is a company qualified to house DIF

documents. This expense is annual and I expect the DIF will pay for this

service again in January.

Please consider funding this proposal. Funding we receive directly effects our strategy.

--Darren

This proposal is part of two proposals submitted for funding this cycle.

- DIF ongoing funding (300 DASH Nov-Jan)

- DIF suplemental funding (400 DASH Nov only)

Our book keeper has prepared our Q2 balance sheet and profit and loss statement. Please find these below. After those statements you can find an update about Q3 and Q4 activities.

The sheets above are through Q2. The equity in ReadyRaider was reported at a

different valuation in Q2 because supervisors identified a reporting

error early on. The new valuation was the value of the Dash ash

ReadyRaider received it. This valuation change is only for reporting and

should not reflect on ReadyRaider as a business. The closing of

Valkyrie's Series A valued the DIFs equity at a multiple. You may notice

2.7 BTC on our balance sheet. This was set aside for the purchase of

rune of THORChain. Those purchases began shortly into Q3.

In Q3 the DIF was very active with meetings, however our financial situation

was not that eventful. The DIF offered a $50k line of credit to CrayPay

secured by Dash and giftcards. The DIF felt the banks could not

accurately price the risk of accepting Dash as there is no charge back

risk with Dash. The DIF offered to provide credit at a lower interest

rate compared to the banks. CrayPay also made an interest payment (in

Dash to the DIF) in Q3. In Q3 the DIF also invested an additional $100k

in CrayPay. Two main reasons for this is we learned that CrayPay is even

stronger of a business than it was a year ago. We were also pleased

with the delivery of DashDirect.

In Q4 we have invested $450k in two companies, we are waiting on the green light from our new partners before we disclose them.

Expenses in general

From our profit and loss statement, you can see the management costs in

Q1. Two of these items are for each of our directors. The smaller item

is for the secretary which is a company qualified to house DIF

documents. This expense is annual and I expect the DIF will pay for this

service again in January.

Please consider funding this proposal. Funding we receive directly effects our strategy.

--Darren

Show full description ...

Discussion: Should we fund this proposal?

Submit comment

|

No comments so far?

Be the first to start the discussion! |

I'm noticing this with the Incubator as well. More developers are take us seriously as an option to spend time with when they can see that we have a big fund to work with (they want to know that their time invested can be sustainable long-term).

Anyway jump here to have full insight.

https://www.dash.org/forum/threads/information-about-dif-november-2021-asks.52394/

Also this DIF Supplemental funding budget proposal (400 dash) does not really explain the reason behind the funding request.

So for this specific budget proposal i will be voting no.

Recently, we used to submit monthly proposals relatively late in each budget cycle that were calculated to fill in the gap of unclaimed funds. But submitting late runs the risk of not getting enough votes and it depends on the two supervisors, who typically submit proposals, being available during a short time window, which sometimes can get tricky when our regular lives get in the way. It also isn't costs-efficient since each proposal costs 5 Dash.

So at our last meeting, we decided to switch to a new model. A recurring base proposal for 3 months at 300, which should leave enough room for other proposals judging from recent activity here. Then, each month, we'd look at the remaining available budget and decide if we want to file a supplementary funding request to put it to use. We expect that in some months a supplementary request beyond the 300 base may not be necessary or suitable saving us extra proposals.

In general though, we think it's best for the Dash network to grow the DIF budget rather than letting the funds go unused. While it increases coin supply, it also allows us to participate in better and bigger deals, take more meaningful stakes, perhaps take a board seat at the target company and ultimately generate more impact for the Dash community. We already had cases were we had to decline an attractive investment simply because the minimum check size was beyond our reach.

Finally, it gives you, the MNOs, more choice. Rather than one all-or-nothing proposal, we want to give you more granularity in deciding at what level you'd like to fund the DIF and it seems like you're already taking advantage of that, qwizzie. :-)

Sven as DIF Supervisor

That said, I'd say give us two weeks, give or take?

Sven as DIF Supervisor