Proposal “DDVirtualVisa“ (Completed)Back

| Title: | DashDirect Virtual Visa/MC |

| Owner: | craymarshallg |

| Monthly amount: | 286 DASH (10754 USD) |

| Completed payments: | 3 totaling in 858 DASH (0 month remaining) |

| Payment start/end: | 2021-08-13 / 2021-11-10 (added on 2021-08-13) |

| Votes: | 844 Yes / 1 No / 9 Abstain |

Proposal description

Proposal

To enable Dash holders to instantly spend Dash anywhere Visa/MC is accepted in the US, for free, through DashDirect.

Method

By developing an instant issuance Visa Card or MasterCard program, Cray Pay will enable DashDirect users to use their Dash Wallet to spend Dash instantly, for free, anywhere that Visa is accepted in the US. Please see Q&A toward the end of the proposal for common questions.

Details

We propose an enhancement to the Cray Pay systems, which will enable us to add instant-issuance Visa or MC virtual cards into the DashDirect application. We will be forming a relationship with virtual card issuers, who will allow us to pre-fund a corporate account. This account can then be used to issue exact-amount virtual Visa/MC cards to DashDirect users instantly. These virtual cards can be provisioned to a phone's Apple Pay, Samsung Pay, or Google Pay wallets, and the user can then pay the merchant with their phone using NFC (in-store) or by entering the card details into a website or app (online). Combined with Cray Pay’s cryptocurrency payment technology, this enables a Dash holder to spend their Dash instantly, anywhere Visa is accepted. While significant discounts will not be feasible in this financial scheme, there may be an opportunity to include a point system to reward users for spending Dash.

True to the crypto-community ethos and our current DashDirect implementation, CrayPay will respect user privacy and allow users to store their Dash in a decentralized non-custodial manner until they are ready to purchase a virtual card. CrayPay will not require KYC or take custody of any funds in this implementation. Critical to our solution’s thesis, users will not be converting Dash to USD and then paying CrayPay. Rather, users will be sending Dash to CrayPay and we will be funding the Visa cards from corporate funds already on retainer with the card issuers, not the user’s funds. In essence, CrayPay is the cardholder, which protects the user’s privacy.

This implementation is distinct from other pre-funded debit card options available in the market. Other cryptocurrency debit card implementations require the user to “pre-fund” their anticipated purchases by custodying their cryptocurrency in an account at the card issuer. This means 1) users do not retain control over the funds and cannot use those funds for any other purchases (and some programs don’t allow the user to withdraw cryptocurrency), 2) users must undergo KYC to open card accounts in their name, and 3) merchants gain access to customer names. The proposed solution resolves all of those shortcomings.

Key Features

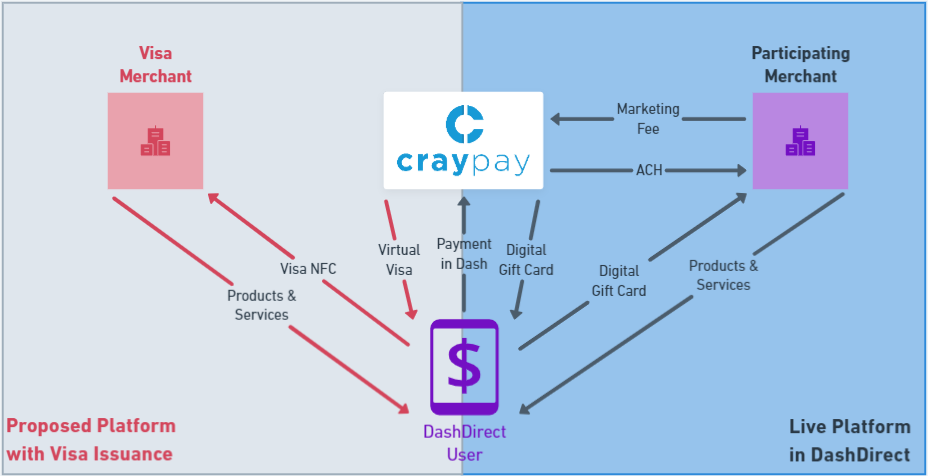

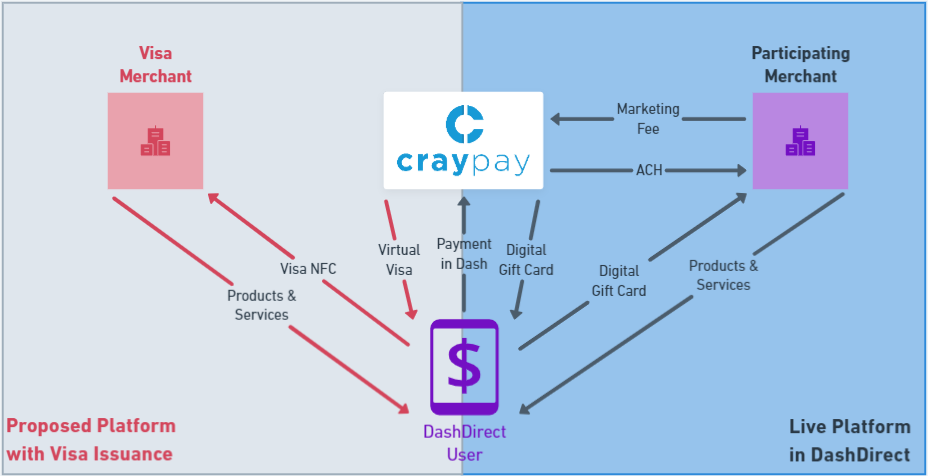

High Level Diagram

Milestones for Feature Launch

Month 1 - Cray Pay will select and negotiate contracts with card issuers who have the capabilities needed, the appetite for crypto transactions, the service level agreements needed to support us long term, and the commercials necessary to make this feasible. Cray Pay has already begun this process and has several candidates selected. Simultaneously, Cray Pay will seek outside counsel on the legal, regulatory, tax, and accounting issues related to this financial scheme. We have already performed initial due-diligence and have a high degree of confidence that we will not encounter any obstacles that cannot be overcome.

Month 2 - Cray Pay will design the UX/UI and integrate the API’s necessary for this feature. Cray Pay will finalize compliance, certification, and accounting configuration.

Month 3 - Cray Pay will develop the front-end integration, and begin testing and QA. Cray Pay will fund the pre-paid corporate account with an estimated volume for 5 days of transactions from all users. A portion of the Dash from the proposal will be used to fund this corporate pre-funded account.

Q&A

Is this an investment in CrayPay? Why isn’t this proposal being submitted to the Dash Investment Foundation in exchange for equity?

The introduction of virtual debit cards is anticipated to have a high cost with very little direct revenue opportunity. Regardless of whether Cray Pay raised additional funding or not, this is therefore a business opportunity we could not pursue without financial assistance. Therefore, a grant to offset the costs of implementation is needed to make this a viable financial decision for the company. We nonetheless feel that it could add functionality for Dash users and add an appealing new capability to the DashDirect app.

What are the benefits to the network, beyond this new service for DashDirect users?

Although the operating profit from this product is anticipated to be quite limited, any profits generated benefit the network in several ways. First, it may increase the appeal of the DashDirect app if it can be used in more places through virtual debit cards. Second, because the Dash Investment Foundation is part owner of CrayPay, the DIF would generate a small financial benefit from any profits. Third, Dash Core Group’s business development fund backstopped a portion of the software development costs of DashDirect, and if certain profit targets are achieved within the contract period, those development costs are waived by Cray Pay. Any profits from the sale of virtual debit cards would help waive the software development liability faster. Once these liabilities are repaid through usage of the app, the savings percentage users receive through DashDirect will increase.

If the product is not profitable, how long with Cray Pay continue supporting it?

Cray Pay will commit to support the product for a period of no less than 1 year after launch. Our hope is that the product will see enough usage that it will become self-sustaining and we can continue supporting it indefinitely. No other major cryptocurrency supports instant payments, so we don’t anticipate being able to offer this non-custodial solution to other networks.

Other card proposals have failed to deliver in the past. What happens to the remaining funds if your card application with Visa is denied?

In the event that Cray Pay - in its best efforts - is unable to secure all of the needed clearances, any remaining funds, less actual expenses incurred, the first $5,000 will be used for promotions and paid to users of DashDirect. The remaining funds will be donated to the DIF.

Other card programs have been offered to the DAO in the past for under $50,000 USD. Why is this program so much more expensive than the past proposals?

The product we propose differs significantly from past offerings. We are not simply proposing a debit card. For example, this solution will be integrated into the accompanying DashDirect app. It depends on proprietary systems to purchase the cards instantly and deliver them to the Apple or Google wallets. We must integrate NFC functionality. All of this requires us to apply for our own card issuance capability. Legal work is required to ensure our unique KYC and privacy protections are created in compliance with regulatory requirements. In short, this more advanced product is significantly more effort than issuing a simple debit card. A portion of the funds will also be deposited with the card issuer(s) to maintain minimum reserves and provide the funds for each card issued, prior to our receipt of funds from the user. This rolling reserve will be replenished regularly from the proceeds of each transaction.

Why aren’t you instead focusing on rolling out DashDirect to [insert country here]?

It is very early for us to give an estimate with any accuracy regarding expansion to new regions, being only two weeks after launching this new product in the U.S. There is a lot to consider to launch a product in a different region, not the least of which is getting merchant partners and integrating with them. We have access to merchant partners in other regions and we are exploring options that would facilitate other regions without those partnerships in place. We cannot in good conscience set a date range, as we are simply too early to have properly vetted the legal, logistical, financial, regulatory, and business case. That said, we are working in that direction. We appreciate the great interest we've seen from the community, both inside the U.S. and in other regions. We will get more clarity and outside validation for the proposition and report back to the community if/when it is viable to expand into other regions.

In the meantime, we view a virtual card issuance solution as a way to introduce support for any region in which Visa is accepted. We are also evaluating the possibility of issuing cards from different regions (not simply being able to use U.S. cards in other regions). This would enable the largest scale quickly compared with building out one region at a time through local merchant partnerships, which is a painstaking process.

Background

In January 2021, the Dash Investment Foundation made a $100,000 investment into Cray Pay, Inc (convertible note instrument) and Dash Core Group entered into a white label development and marketing agreement with Cray Pay. The intent of both of these relationships was for Cray Pay to develop a white label version of the CrayPay flagship mobile payment application, with the added features needed to enable instant, free, Dash payments and increased instant cashback offers.

What is DashDirect?

DashDirect is the first mobile payment application to allow instant, seamless spending of Dash cryptocurrency with over 155,000 U.S. stores and websites. Users pay directly with their Dash Wallet, for free, instantly. Additionally, DashDirect gives users an average of 5% instant savings on their purchases. DashDirect was launched on July 27, 2021, with significant media coverage, and excellent user feedback.

Press:

Newsweek Exclusive Launch Announcement

Yahoo! Finance

NASDAQ

Investing.com

CoinDesk

CoinTelegraph

And hundreds more…

Video Content

Community Feedback for DashDirect

“DashDirect is quite literally a revolution in the crypto space. This app is changing the way people view an entire industry. Crypto is an asset you buy, sell or hold. Now, it is an asset you can spend. This is so groundbreaking in that it is also a full solution - the vendors, the GPS, the interface, everything. The reviews on both app stores are stellar. This is the killer app people have been anticipating for years. It allows for mass adoption which was never possible before this came together.” - Arden Goldstein, Head of Marketing, DCG

“I live unbanked off crypto, and am used to struggles of trying to use it in real life. Not anymore. DashDirect makes it extremely easy to not only find where I can spend it, but actually go through the payment process. You can pay with Dash without holding up the line, and save a lot of money. This is the first app I can actually recommend to friends and family who aren't already into crypto, because I know they'll find it easy enough to use to overcome the learning hurdle.” - Joel V, App Store

“Awesome app. Great that you can finally spend a crypto this easily. Dash is changing the game. Love it.” - DashDirect User, App Store

“This is truly amazing. I can finally spend my Dash directly at so many locations. I tried it out at CVS yesterday and it worked like a charm. It was instant and seamless. Dash has now solidly cemented itself as the leading crypto in the retail environment.” - DashDirect User, App Store

“Bought lunch at subway sandwiches for everyone yesterday. Then bought stuff from Home Depot! Worked perfectly! So excited to use Dash to buy things now, and at a REAL discount!!!” - DashDirect User, App Store

“Great stuff. Maybe someday somebody from the future once the speculative driven market is gone will find this thread and realize: "these guys are the true pioneers that eventually lead to a world with more economic freedom" - Bitcoin Cash Ambassador, Reddit

Dozens more 5-Star Reviews...

Conclusion

CrayPay is excited to bring another groundbreaking feature to the Dash community, through innovation, strategic partnership, and community support. Unfortunately, we cannot justify the cost of this feature on a stand-alone basis, as the revenue opportunity is minimal. Your financial support for this revolutionary solution is necessary and greatly appreciated.

To enable Dash holders to instantly spend Dash anywhere Visa/MC is accepted in the US, for free, through DashDirect.

Method

By developing an instant issuance Visa Card or MasterCard program, Cray Pay will enable DashDirect users to use their Dash Wallet to spend Dash instantly, for free, anywhere that Visa is accepted in the US. Please see Q&A toward the end of the proposal for common questions.

Details

We propose an enhancement to the Cray Pay systems, which will enable us to add instant-issuance Visa or MC virtual cards into the DashDirect application. We will be forming a relationship with virtual card issuers, who will allow us to pre-fund a corporate account. This account can then be used to issue exact-amount virtual Visa/MC cards to DashDirect users instantly. These virtual cards can be provisioned to a phone's Apple Pay, Samsung Pay, or Google Pay wallets, and the user can then pay the merchant with their phone using NFC (in-store) or by entering the card details into a website or app (online). Combined with Cray Pay’s cryptocurrency payment technology, this enables a Dash holder to spend their Dash instantly, anywhere Visa is accepted. While significant discounts will not be feasible in this financial scheme, there may be an opportunity to include a point system to reward users for spending Dash.

True to the crypto-community ethos and our current DashDirect implementation, CrayPay will respect user privacy and allow users to store their Dash in a decentralized non-custodial manner until they are ready to purchase a virtual card. CrayPay will not require KYC or take custody of any funds in this implementation. Critical to our solution’s thesis, users will not be converting Dash to USD and then paying CrayPay. Rather, users will be sending Dash to CrayPay and we will be funding the Visa cards from corporate funds already on retainer with the card issuers, not the user’s funds. In essence, CrayPay is the cardholder, which protects the user’s privacy.

This implementation is distinct from other pre-funded debit card options available in the market. Other cryptocurrency debit card implementations require the user to “pre-fund” their anticipated purchases by custodying their cryptocurrency in an account at the card issuer. This means 1) users do not retain control over the funds and cannot use those funds for any other purchases (and some programs don’t allow the user to withdraw cryptocurrency), 2) users must undergo KYC to open card accounts in their name, and 3) merchants gain access to customer names. The proposed solution resolves all of those shortcomings.

Key Features

- Complimentary: This feature will compliment the existing merchant network and functionality and will be integrated into the slick DashDirect interface.

- Private: This feature will not require any AML/KYC, but will be subject to daily and transaction limits per regulatory requirements. Additionally, Cray Pay does not know what a user purchases. Our merchants do not have access to any of the user’s private information.

- Non-Custodial: Users hold their funds in and pay with the secure Dash Wallet.

- True Crypto Payments: Users will be able to instantly spend Dash almost anywhere, by paying Cray Pay directly with Dash, not USD.

- Potentially Global: This may allow non-US Dash holders to spend Dash in their region, without needing to add a direct merchant network first. We will confirm compatibility for non-US merchants with the specific card issuers as negotiations progress.

- Revolutionary: Through DashDirect, Dash will become the Dominant Crypto for Retail Payment Utility.

High Level Diagram

Milestones for Feature Launch

Month 1 - Cray Pay will select and negotiate contracts with card issuers who have the capabilities needed, the appetite for crypto transactions, the service level agreements needed to support us long term, and the commercials necessary to make this feasible. Cray Pay has already begun this process and has several candidates selected. Simultaneously, Cray Pay will seek outside counsel on the legal, regulatory, tax, and accounting issues related to this financial scheme. We have already performed initial due-diligence and have a high degree of confidence that we will not encounter any obstacles that cannot be overcome.

Month 2 - Cray Pay will design the UX/UI and integrate the API’s necessary for this feature. Cray Pay will finalize compliance, certification, and accounting configuration.

Month 3 - Cray Pay will develop the front-end integration, and begin testing and QA. Cray Pay will fund the pre-paid corporate account with an estimated volume for 5 days of transactions from all users. A portion of the Dash from the proposal will be used to fund this corporate pre-funded account.

Q&A

Is this an investment in CrayPay? Why isn’t this proposal being submitted to the Dash Investment Foundation in exchange for equity?

The introduction of virtual debit cards is anticipated to have a high cost with very little direct revenue opportunity. Regardless of whether Cray Pay raised additional funding or not, this is therefore a business opportunity we could not pursue without financial assistance. Therefore, a grant to offset the costs of implementation is needed to make this a viable financial decision for the company. We nonetheless feel that it could add functionality for Dash users and add an appealing new capability to the DashDirect app.

What are the benefits to the network, beyond this new service for DashDirect users?

Although the operating profit from this product is anticipated to be quite limited, any profits generated benefit the network in several ways. First, it may increase the appeal of the DashDirect app if it can be used in more places through virtual debit cards. Second, because the Dash Investment Foundation is part owner of CrayPay, the DIF would generate a small financial benefit from any profits. Third, Dash Core Group’s business development fund backstopped a portion of the software development costs of DashDirect, and if certain profit targets are achieved within the contract period, those development costs are waived by Cray Pay. Any profits from the sale of virtual debit cards would help waive the software development liability faster. Once these liabilities are repaid through usage of the app, the savings percentage users receive through DashDirect will increase.

If the product is not profitable, how long with Cray Pay continue supporting it?

Cray Pay will commit to support the product for a period of no less than 1 year after launch. Our hope is that the product will see enough usage that it will become self-sustaining and we can continue supporting it indefinitely. No other major cryptocurrency supports instant payments, so we don’t anticipate being able to offer this non-custodial solution to other networks.

Other card proposals have failed to deliver in the past. What happens to the remaining funds if your card application with Visa is denied?

In the event that Cray Pay - in its best efforts - is unable to secure all of the needed clearances, any remaining funds, less actual expenses incurred, the first $5,000 will be used for promotions and paid to users of DashDirect. The remaining funds will be donated to the DIF.

Other card programs have been offered to the DAO in the past for under $50,000 USD. Why is this program so much more expensive than the past proposals?

The product we propose differs significantly from past offerings. We are not simply proposing a debit card. For example, this solution will be integrated into the accompanying DashDirect app. It depends on proprietary systems to purchase the cards instantly and deliver them to the Apple or Google wallets. We must integrate NFC functionality. All of this requires us to apply for our own card issuance capability. Legal work is required to ensure our unique KYC and privacy protections are created in compliance with regulatory requirements. In short, this more advanced product is significantly more effort than issuing a simple debit card. A portion of the funds will also be deposited with the card issuer(s) to maintain minimum reserves and provide the funds for each card issued, prior to our receipt of funds from the user. This rolling reserve will be replenished regularly from the proceeds of each transaction.

Why aren’t you instead focusing on rolling out DashDirect to [insert country here]?

It is very early for us to give an estimate with any accuracy regarding expansion to new regions, being only two weeks after launching this new product in the U.S. There is a lot to consider to launch a product in a different region, not the least of which is getting merchant partners and integrating with them. We have access to merchant partners in other regions and we are exploring options that would facilitate other regions without those partnerships in place. We cannot in good conscience set a date range, as we are simply too early to have properly vetted the legal, logistical, financial, regulatory, and business case. That said, we are working in that direction. We appreciate the great interest we've seen from the community, both inside the U.S. and in other regions. We will get more clarity and outside validation for the proposition and report back to the community if/when it is viable to expand into other regions.

In the meantime, we view a virtual card issuance solution as a way to introduce support for any region in which Visa is accepted. We are also evaluating the possibility of issuing cards from different regions (not simply being able to use U.S. cards in other regions). This would enable the largest scale quickly compared with building out one region at a time through local merchant partnerships, which is a painstaking process.

Background

In January 2021, the Dash Investment Foundation made a $100,000 investment into Cray Pay, Inc (convertible note instrument) and Dash Core Group entered into a white label development and marketing agreement with Cray Pay. The intent of both of these relationships was for Cray Pay to develop a white label version of the CrayPay flagship mobile payment application, with the added features needed to enable instant, free, Dash payments and increased instant cashback offers.

What is DashDirect?

DashDirect is the first mobile payment application to allow instant, seamless spending of Dash cryptocurrency with over 155,000 U.S. stores and websites. Users pay directly with their Dash Wallet, for free, instantly. Additionally, DashDirect gives users an average of 5% instant savings on their purchases. DashDirect was launched on July 27, 2021, with significant media coverage, and excellent user feedback.

Press:

Newsweek Exclusive Launch Announcement

Yahoo! Finance

NASDAQ

Investing.com

CoinDesk

CoinTelegraph

And hundreds more…

Video Content

Community Feedback for DashDirect

“DashDirect is quite literally a revolution in the crypto space. This app is changing the way people view an entire industry. Crypto is an asset you buy, sell or hold. Now, it is an asset you can spend. This is so groundbreaking in that it is also a full solution - the vendors, the GPS, the interface, everything. The reviews on both app stores are stellar. This is the killer app people have been anticipating for years. It allows for mass adoption which was never possible before this came together.” - Arden Goldstein, Head of Marketing, DCG

“I live unbanked off crypto, and am used to struggles of trying to use it in real life. Not anymore. DashDirect makes it extremely easy to not only find where I can spend it, but actually go through the payment process. You can pay with Dash without holding up the line, and save a lot of money. This is the first app I can actually recommend to friends and family who aren't already into crypto, because I know they'll find it easy enough to use to overcome the learning hurdle.” - Joel V, App Store

“Awesome app. Great that you can finally spend a crypto this easily. Dash is changing the game. Love it.” - DashDirect User, App Store

“This is truly amazing. I can finally spend my Dash directly at so many locations. I tried it out at CVS yesterday and it worked like a charm. It was instant and seamless. Dash has now solidly cemented itself as the leading crypto in the retail environment.” - DashDirect User, App Store

“Bought lunch at subway sandwiches for everyone yesterday. Then bought stuff from Home Depot! Worked perfectly! So excited to use Dash to buy things now, and at a REAL discount!!!” - DashDirect User, App Store

“Great stuff. Maybe someday somebody from the future once the speculative driven market is gone will find this thread and realize: "these guys are the true pioneers that eventually lead to a world with more economic freedom" - Bitcoin Cash Ambassador, Reddit

Dozens more 5-Star Reviews...

Conclusion

CrayPay is excited to bring another groundbreaking feature to the Dash community, through innovation, strategic partnership, and community support. Unfortunately, we cannot justify the cost of this feature on a stand-alone basis, as the revenue opportunity is minimal. Your financial support for this revolutionary solution is necessary and greatly appreciated.

Show full description ...

Discussion: Should we fund this proposal?

Submit comment

|

No comments so far?

Be the first to start the discussion! |

https://bit.ly/3csUQID

We are posting updates on our progress on the Dash Forum and in the DashDirect Discord channel. Official updates can be found here:

https://www.dash.org/forum/threads/dashdirect-virtual-visa-mc-proposal-updates.52044/

FYI

Attached this link to serve you as inspired by ideas:

https://paywithmoon.com/faqs

'The Moon Visa Prepaid Card is a virtual card that can be loaded with cryptocurrency.'

Can the card be used in the European Union?

https://youtu.be/u6r3QyaxqQs

Could you please outline how CrayPay generates revenue from this addition, even if "quite limited"? Unlike the marketing fee on the gift card side, your high-level diagram doesn't show any money flow to you on the Visa side. Are you going to add margins on the Dash/USD exchange rate, participate somehow on credit card merchant fees, something else? How is this going to become a self-sustaining product for you?

What's hilarious is that downvotes here have no consequence for me, but they do prove (without accompanying justification) that you don't like what I'm saying wish to silence me. This is censorship. Good actors wouldn't do that...Thank you for this evidence.

Looking forward to bring DashDirect solution into Europe too.

I have also requested that this link be added to our website. I can update the file, without changing the link, so it shouldn't be too cumbersome to maintain this way.

https://www.bromite.org/fdroid

The value cost proposition of this proposal in terms of expanding merchant accessibility for payments in Dash doesn't get any better than this. We will be able to spend Dash anywhere Visa is accepted in the United States without the need to do any KYC.

Just some numbers.

Visa is the most widely accepted in the U.S. at approximately 11 million U.S. merchant locations!

Total proposal request = 858 Dash over 3 Months

900 Dash at the current $184 price point is = $157,872 for access to 11 million U.S. merchant locations!

The value cost proposition for a dedicated Dash solution with a DIF feedback loop is well worth it for the utility it delivers for a payment focussed cryptocurrency!

It's also been an absolute pleasure to work with Marshall and the rest of the CrayPay team.

One quick question for you Marshall that I don't think the proposal addressed - If this proposal passes and the Dash price rockets up (fingers crossed) and appreciates in USD value over the next few months and there are remaining funds left over from this proposal. What will you do with the remaining funds?

Perhaps you could apply it to future DashDirect marketing efforts?

To address the question about potential price increases, we would gladly apply the balance to marketing efforts. We will run promotions, referral bonuses, increased discounts on DashDirect purchases and/or other incentives to put the funds towards direct growth of Dash utilization. If the surplus is significant, we will donate the remainder to the DIF, to support investments into other growth opportunities.

and then I read on and saw that the solution is non-custodial and no KYC and now I am changing my vote to a HELL YES !!!

With regards to your budget proposal, you have my support.